First-time fundraising is hell - maybe this helps 💰

Dec 2, 2022 · 13 min read · 6,304 views

Goal of this document is to help you - founders who are currently raising their first round in these weird uncertain times.

It’s based on my personal learnings as a founder, operator, and investor in several companies. As usual, if you know how to improve it please send me a PR.

So you struggle fundraising? Tons of calls but nobody invests… That's not you. That’s normal.

Why?

Your round is either hot or it’s cold. And rarely anything in-between.

The typical scenario is that a first-time founder struggles forever to convince anyone to invest into their company… and then… all of a sudden… everyone wants to invest and they struggle to convince people to invest less or even stay out of the round all together.

And this state could flip from one week to the other…

The naked truth

Most investors want to follow market interest. Especially in a market where it might be hard for them to raise a new round they don't want to invest in someone completely on their own, and then realize that company doesnt have enough money to actually get to their next stage, that this company will just fizzle out and die. They don't want to invest in a good product idea, done by the wrong team.

They want to join when a round will 100% happen and multiple investors already agreed that this company is a good investment.

When they talk to their LP's it's frequently better for them to say they competed for hot rounds – even if they didn't get in - then to invest in startups that stayed cold forever. It's better to name startups that got hyped in their portfolio and pay a higher price, then name companies that their LPs never heard of and lost their money all the same.

The naked truth is that most investors are followers not leaders. And this is not a weakness of character. This is the job. Know about companies early and invest as late as possible (to derisk), while still being early (to get a good price). As odd as it's sounds, their job is not to invest in the best companies but in the ones that the next investors will consider the best. They don't want to be contrarian, they want to be earlier. Nobody ever got fired for buying IBM, nobody will get fired for investing in last summer's hottest startups.

If they write smaller checks, they want to join the round when it happens. If they write bigger rounds they'll try to push another large investor out once they realize others are interested.

Your startup's round is ice-cold, until… all of a sudden… everyone wants to join – Your round became hot.

And two weirdest things about this… 1) this is completely normal and 2) you never know when it's happening. Your deal could never become hot, maybe tomorrow, maybe next week, or maybe today after your next call…

A few mental models that might help you think differently about your fundraising round

First let's talk about a few mental models that help you think the right way about your fundraising round.

You raise based on expectations

The most confusing thing to most first-time founders is that you are not raising money on a “reality-based” market.

No offense to any readers here, but no company that early, is worth $5M, $7M or $15M. You are raising on an “expectation-based” market. The expectation where your company could go, and the “worry” to not be part of that journey, is what is “worth” that valuation.

But what changes expectations? Momentum, Narrative and Proof-points.

Momentum, Narrative, Proof-points

Momentum

The ability to close a round successfully is mainly about momentum.

Think of a train-station. The job of a VC is to

- Know which trains are around and where they want to go

- See which trains are leaving the station right now and know if they want on it

- Jump on the train in the last moment they can without having to run to the next station to catch it there

Differently put, be as late as they can, but still be early – or from their POV: gather as much data as possible for the decision.

VCs have people on staff who’s job is it to get to know everyone in the trainstation and hear who’s train is heating up.

It’s their job to jump on calls with you and keep being interested. They get paid for this time spent. You don’t.

Narrative

Make it easy for an investor 1) remember and 2) explain what you are doing and 3) why it’s exciting.

The ideal narrative connects to larger market trends, so that they can bet less on you and more on the overall market shift.

Are you selling books via a website – or are you part of a customer behavior shift of purchasing everything online.

Are you a car-rental service with an app – or are you rethinking urban transportation?

Are you doing Y – or are you doing something that a very successful company X did but apply it the Y-industry?

Proof-points

“We would like to see a bit more traction…” – Now what the hell does this mean.

Sure – if you can 3x your ARR in the next two months they’d be excited to hear about it. But there are other ways around it, if you can’t increase revenue that much yet.

Let’s get tactical

Here a list of strategies you can apply to hopefully improve your fundraising chance…

“Traction” is whatever you say it is.

It's hard to provide more proof-points for your momentum if you only look at revenue.

But as long as you can argue why this number or effort is meaningful to your business and investors agree with you, you can use any number to show your traction.

- Lack revenue? Look at some other number that makes sense for your product/company

- Lack the total numbers that impress? Look at growth %

- Lack the growth %? Look at a subset of customers that have breakout engagement or feedback

Even if they don't agree with you 100% on this number, they have to acknowledge that this number is going somewhere – traction is noticable.

Be less comparable

When investors say they want to see more traction they usually mean that they don’t believe your innovation is unique enough to drive demand and/or your credentials aren’t big enough to make a blind bet. So they want you to proof in execution. (Read this related article)

Frequently it’s easier to rethink your positioning than to improve your numbers. I am not saying you should change what you are doing just to please investors. But can you rethink your narrative a bit? It might also make it easier for you to acquire customers because you become more unique.

Roy Bahat frames this really nicely in his talk. Ideally Investors want to summarize you as “the only” or “the first” and brag with you to their partners.

Not fundraising but…

My main recommendation is to not officially fundraise until you have a clear feeling you can close your round.

This is very easy… you just say… “We are not [yet] fundraising, but…” and then add whatever feels right for you. For example: “but I am happy to jump on a call to show you what we are up to and get your feedback” or “but i would love to get your advice” or “but i would love to get to know and establish a relationship”.

No worries, investors have no problem to hear about stuff before the market. 🤷♀️

If you feel a person could be a potential angel investor, and they have interest, you can always use a SAFE to close them.

If they are a fund, you can try the same – but keep in mind that unless you have two or more funds interested, you might have none.

Tranching a round

Doing your round in smaller steps.

If you struggle getting momentum in your round consider tranching your round by getting a few angel investors in first at lower valuations.

Most investors want to follow, not lead a round. Which is horrible for you as a founder as you end up with a lot of people who soft-commit (“would love to” hear from you once you have a lead).

Use SAFEs and lower valuations to lock in people. Get them to hard-commit (people signing SAFEs and wiring money) instead of “sure if you find a lead maybe” soft-commits. Ideally use them for more introductions and maybe also introductions to larger early stage funds.

Elizabeth Yin explains this better than i could so i just recommend you to read her thread on this.

Having people commit shows momentum. And if meanwhile, you realize that you might have escape-velocity and larger funds are interested you can increase the valuation of the next SAFEs or start a larger round. If the timing is close enough you can mention the previous SAFEs as part of your funding round size.

Be clear what you are looking for…

This is a very typical tactical mistake:

1) Valuations

You should have a valuation and amount you want to raise in mind.

“We are waiting for a lead to define the valuation” just means that nobody gave you ballpark numbers yet (most likely because you arent interesting enough) and it also means that nobody you talk to can commit if they are excited about it.

If you aren’t sure about your valuation yet, you should still be able to say something.

In case of doubt communicate it like Harry Hurst recommends here. Also look at AngelList’s numbers, but consider the lowest 25th percentile (those stats suffer from very very strong survivorship bias).

2) Introductions

Have a list of people you would love to have introductions to. This allows each person you talk to become a multiplier and increases your momentum. People are usually more open to give introductions over investing and it allows you to increase your momentum.

Continue closing angel investors

I actually explained this approach in this 9 years (gasp!) old article of mine – but it’s worth repeating here:

Every first-time founder does the same mistake. They look for “startup investors”.

By doing that they end up finding the same few startup investors, who have strong twitter or podcast persona and approach them – like hundreds and hundreds founders more.

Those well-known investors usually get way too much inbound for you to stick out without a warm introduction.

And even with a warm introduction, most likely you lack the proof-points and momentum for them to commit. So you will have a lot of calls with people who want to see if your “train might leave the station” but don’t want to jump on it.

Who to approach

Get domain experts for what you are doing as angel investors – but make sure they aren’t competitive.

It’s easy:

Think through what your main bets are that an investor has to subscribe to if they are making your deal. And make a list of those.

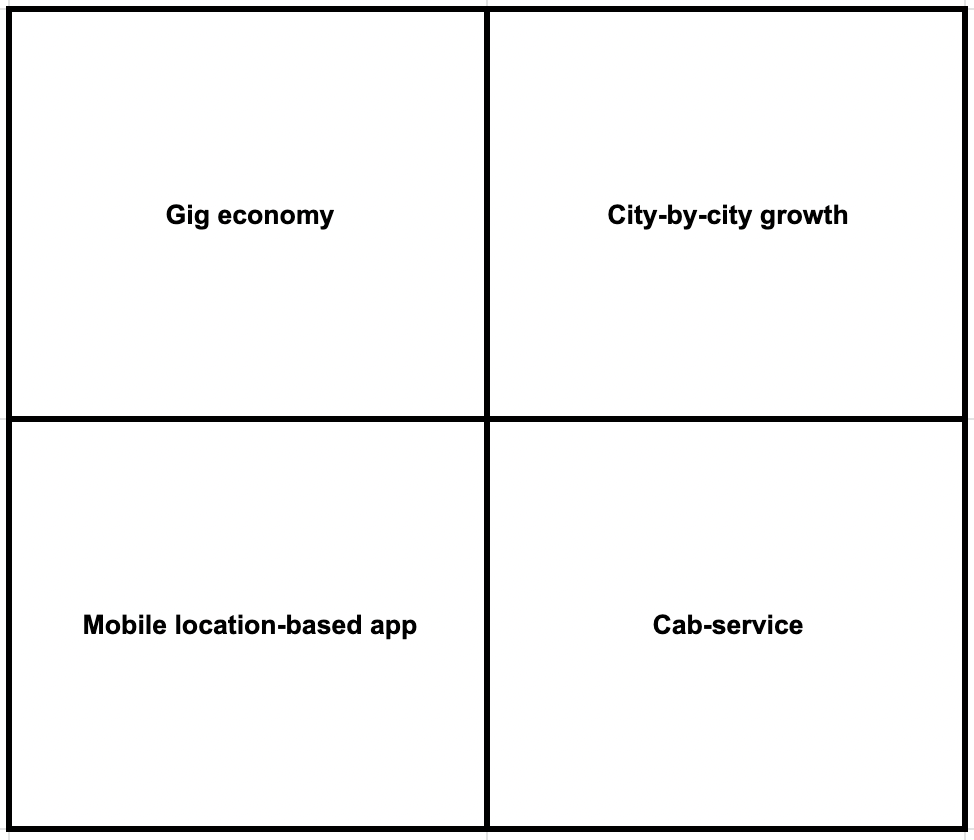

If you struggle to think that way, which – i admit – is a bit weird if you are so close to your own business, try this alternative approach: Draw a 2x2 grid and write in each of the four boxes one aspects that make your business.

No matter if you go the bets or the 2x2 route – You should end up with a list of areas that are uniquely make up your business.

Now the main question: Who are the top people in the world for these individual areas? Write a list.

Ideally those are founders of companies who did an aspect of what you do but aren’t competitive to your company as a whole.

In the example above this could be someone who built a startup that had city-to-city growth as a challenge in their business but not in context of a car company (eg food delivery?). Or did location-based apps (social app?). Or maybe they build a business in your industry and understand your industry really well because of it.

You are now approaching other founders who have shared interests with something innovative in their field and you ask for their expertise. This is a way more interesting cold-email. Additionally they are most likely less swamped with startups reaching out to them then the typical “startup investor”.

Ask them to give you feedback about your actual challenges! Not because of the old saying "ask for money get advice, but ask for advice and get money" but for the simple reason that they have a ton of useful experience you need to hear.

Establish a relationship, ask them for further introductions to the people on your list.

In a perfect world you can do a small advisory angel round with them and they might even be able to introduce you to their favourite VCs. Imagine being a VC getting an intro request of an AI startup via your favourite “AI founder”.

Keep building

For my first startup we raised for almost a year in total. Fundraising is a highly time-consuming job. You can assume that one person on the founding team will do this full-time.

We had great discussions with VCs, regular checkups, even serious partner meetings. We got so much feedback and homework to keep us busy. At the end of it – based on investor feedback – we had a business plan (those were still a thing back then) in two languages, several dozens of versions of our pitchdeck and a finance model that could even do end-of-year balancing. But none of that helped us to close the round. That only happened much later and with the help of Seedcamp.

Then I worked on a company that actually had traction and everything was different. People saw how our train moved and wanted to get on board. As quickly as they could.

The biggest mistake we did in my first startup was to focus most of the founders on fundraising. We should have just kept most of the founding team "heads down" and let them keep building.

VCs usually don’t know what they want until they see it – or better – others want it as well. Very few VCs are comfortable being the first check in a startup without a larger round and they will drag their feet and even give you homework as long as they can.

Don’t let that make you crazy. Your job is to build a great company, not to tell stories to VCs or do homework for them. Too many people say “if we manage to fundraise we will…” Entrepreneurship is about entering the market – not about "*if-*ing" your future.

Build, get customer feedback, learn, move fast. Be “not fundraising but…” and gain momentum. And hopefully some of the tactics above will help you raising that money.

Good luck! ✌️

Andreas

PS: As always send me your feedback via twitter. If you got ways to improve this article please submit a PR.