Drafting your first investment round.

May 6, 2013 · 10 min read · 3,081 views

The topic of investing is omnipresent in our startup world. Sooner or later most startup founders look for external funding. And it’s great that there is already a lot of great advice on this topic out there.

The advice I want to focus on is a bit more fundamental.

It’s about getting to your very first investment round.

Disclaimer: Like any advice, this advice here is just personal opinion based on subjective experiences put into some half-baked context. I would like to encourage you to peer-review this post and send me your change suggestions using this link on Draft or simply comment in this thread in Hacker News.

“Looking for angel investors”

The most common mistake I notice is that startups often begin looking for “angel investors”. They go to networking events, local media, ask other entrepreneurs in their area . They ask around and try to see who in their direct or indirect network fits the criteria of an “angel investor” - people who have a track record or reputation of investing into startups.

Out of this shortlist they pick their favorites based on public success stories and reputation, and quickly start approaching/pitching them. If this doesn’t work they lower their expectations and look for other wealthy people they know or at least know indirectly.

I acknowledge the tricky situation every fundraising entrepreneur is in, but the truth is that this approach values proximity and availability over quality and purpose. You need to be aware of that when walking down that path.

All of a sudden mobile-health startups have CEO’s of marketing agencies as investors who - even if they are highly skilled business people - cannot create provide the most meaningful input possible apart of supplying cash in exchange for (very valuable!) control.

The method above also enforces a behaviour where the local “super angel” of your city gets approached by nearly everyone. Again, for the wrong reason.

A lot of people have money. However, this doesn’t necessarily mean they are the best possible investors for your startup.

That being said it is advisable for the entrepreneur to go the extra mile and bang those doors, he knows he needs to get in, even harder.

I got the following advice from an investor in our last startup, and I have been sharing it ever since:

Draft your round

When you start raising your round, before you reach out to investors - sit down, and do the following to find the profiles of the best possible people to join you as angel investors:

First of all, split your company into its main aspects.

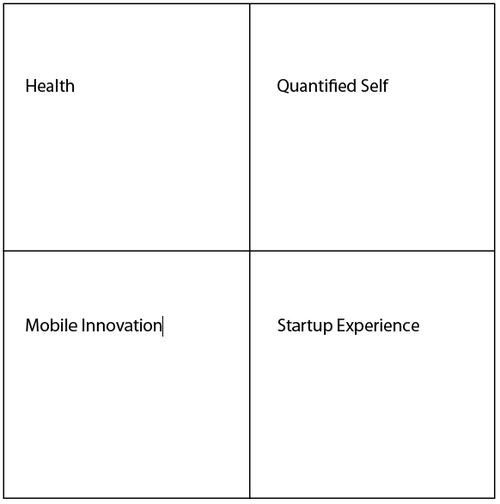

I usually take a pen and paper and draw a rectangle made out of 4 boxes. In each of the boxes write one of the core fundaments of the business.

Let’s imagine you run a P2P yacht rental Airbnb-like startup. Rich people rent their yachts to other rich people

I am making this up on the fly. Sorry if it is either complete bollocks or, by accident, your startup ;)

Or let’s imagine you are a “private cloud” hardware business and sell ready-to-go servers that provide Dropbox for local networks.

Your 4 core boxes would be:

Or imagine you run a mobile health business that measures your blood-pressure using the iPhone vibration sensor while you sit. (again… making this up the fly. But wouldn’t be surprised if someone at Singularity University is already working on this.)

Fill the boxes:

At least one of the boxes should reflect a old-economy (or older internet generation) version of your business.

E.g. Car rental if you do uber. Ebay if you do mobile ebay.

One of the boxes should be related to your engine of growth. Think Community, Sales, SEM, etc - What is the core aspect of your growth.

I usually prefer to have one of the boxes to be a “startup experience”. The person filling this slot will be someone who has done a few successful investments and can help the other investors with guidance and also back you up if the other angels, who are not so experienced with startups, are turned off by your strategies. Also this person will be very useful for your follow-up rounds, assuming you get to that stage.

Digging deeper

Let’s define each of the fields in a bit more detail.

What characteristics do the perfect people have in those boxes? What kind of business person are they? What’s their background, what kind of tasks did they achieve. Did they build the company? …or the mobile product? Did they do the Europe expansion or the R&D of the core product?

Sometimes you need innovators sometimes executors. Sometimes you want the old-school business guy, sometimes the crazy new product guy. But be specific about what characteristics the role needs.

Who would be the best people for your boxes? We are looking for the right people - globally.

Think TED talks, think universities, think nobel prize winners, think household brands, think old-school businesses that kinda did that one aspect but offline, look for established startups that are similar in that very aspect.

Hint: Look for companies that reflect the boxes you just named above without being potential competitors. People run into conflict of interest if your startup’s product is too close to their own affiliations.

Advisory board

If you think that this is very close to a board of advisors than you are right. Your perfect first round of angels are people you would actually want to have as advisors.

Be careful with Strategic Partners

It is very tempting to get a very strong potential long-term growth partner as an angel. But usually this turns out to be a too strong commitment in a too early stage. Most properly you will pivot and no longer need that channel. Look for people and skills, not single resources.

The goal of the angel is not to provide their distribution network, but to give you the insight and help needed to create your own.

Shortlist

Now start shortlisting the top 10 people in each of those boxes. Look for people you would be honored to work with. Even if - in the end - you cannot reach those people, they provide a great mental picture, a benchmark of what you look for.

Reaching out

There is a the common saying:

If you ask for money you get advice. If you ask for advice you get money.

Therefore your first step is to meet them for skype or coffee. They are expert and feedback is all you can ask for.

After some time a mentor or advisor relationship might establish.

But even if it stays within this relationship of “just advice” - that’s great.

Think that way: Even if they in the end don’t invest money, their feedback and introductions will be worth a lot.

Look for people who help from Day 1

In my experience: If someone is overly protective about his skill/network or support he might not have enough of it to offer.

The right people provide value from Day 1. The right people help and network you from Day 1. The right people know they have enough value to provide and are very open with their support.

The round

In a perfect world you have a few weeks or month you work with those people before you open a round with a “lower” valuation, where they can participate.

The perfect round is with advisors willing and capable to help your business and have a downside if they don’t (their investment).

Unfortunately we do not live always in a perfect world. But try to keep this as a guidance. Your goal is to close a advisory round, which benefits everyone.

Hint: Traction and scarcity closes rounds.

As with everything in startups, funding rounds are also defined by their traction. Try to have several of the alpha investors already committed before you open up the round to everyone else.

Hint: Valuations

Every experienced founder will tell you the same. In case of doubt pick the right people over the right valuation.

people > valuation.

Accelerators

In general I would recommend every first time founder to participate in an accelerator. They help avoid the most common mistakes and introduce you to an already built network of the great people.

Remember: Your goal as first-time founder is not to optimise potential. It is to optimise probability of success.

As with everything in the startup world, try to go with the best - ignore the rest. I dare to say that, in this power-law driven game: non-focused B,C,D or F-level accelerators can hardly provide any of the value they promise.

What about VCs?

Personally i would not recommend working with Venture Capital before you are getting closer to product/market fit. But opinions differ here.

There are two kinds of money

- Money for proof (to find product market fit)

- Money for scaling (to repeat customer acq.)

Venture Capital by tradition is the second kind of money. I would actually even go further…

I tend to think of VC capital as rocket fuel.

If you are ready the help you reaching the skies. If you are not it might as well blow up your company.

When you are not ready, they cannot play their strongest cards and their misaligned power and expectations can become straight forward destructive for your startup.

If you want to take VCs into your round, make sure that they also fit one of your boxes mentioned above. Look especially at the background of the partner working with you - VCs are people too. Additionally take a look at their other portfolio companies and make sure that there are synergies in experiences and competences needed.

Be careful with new funds. They are startups themselves, but don’t know it.

Hint: Be careful with miss-understanding VC interest.

VCs want to invest as early (low valuation) as possible. Which from their point of view means as late (last possible moment, lowest possible risk).

A VCs needs to see you performing over time to make a real commitment.

The first time I meet you, you are a single data point. I invest in lines. – Mark Suster

Summary

Never put proximity and availability over quality or purpose. Find the optimal people for your startup. Or approximate them as closely as possible. If you get people in just for the money no-one will profit in the end.

I hope this article is useful to you. If you have any questions please contact me via twitter. Also as mentioned this is article meant to be a peer-reviewed source for early stage founders. Therefore I would highly appreciate your change-suggestions via Draft or comment in this Hacker News thread.

Until then, all the best. @andreasklinger

PS: Thanks to @tamaslocher, @lfittl and countless others for adding their feedback!