How i make investment decisions 🏝

Aug 26, 2022 · 7 min read · 10,119 views

The goal of this article is to break down how i make investment decisions in the hope that it helps founders to see their fundraising effort from the “other side”.

If you have ideas how to improve it please send me a PR on github!

About me

- I did a few dozen angel investments

- most of them very early-stage, usually first-round, pre-seed or even first-checks

- FWIW i don’t consider myself an expert investor

- more an founder/angel who is absurdly opinionated and got lucky a few times

- so please take everything here with a grain of salt

- Read more about my investments here remotefirstcapital.com

Before we start: The bad news

Investors do fundraising negotiations for a living. Every day.

They have seen deals like yours, they know how good pitches look like.

Especially if you are doing this for the first time, the odds are stacked against you. And this isn’t fun. If you struggle with this, know that you aren't the only one.

Ok now… Let’s try to change the odds.

How I make investment decisions

Most investors will tell you that they look for "founders, market size, potential, grit…" and alike.

I always found this EXTREMELY non-actionable as a founder.

What are you now supposed to do? Guess what the VC thinks "grit" means or how a “strong founder” looks like? I assume like a Stanford grad without accent? Also what the hell does market size mean? You are early-stage. You might pivot and your market should grow.

Also, most VCs don't give you the reason why they reject you, or worse prefer to string you along by faking interest and/or giving you homework.

When i started investing i wanted to do this differently

I tried to find decision frameworks for myself that I can transparently communicate, hold myself accountable to, and use as a shared language for feedback and advice.

The two mental models i use:

Framework #1: Innovation, Execution, Credentials

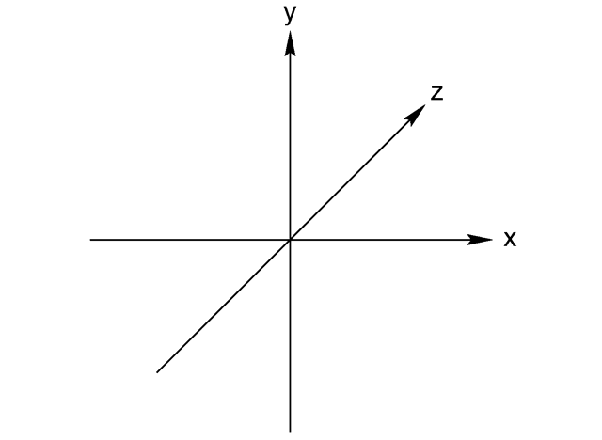

I look at every deal from 3 axis: Innovation, Execution, Credentials.

Think of this as a 3d space and me trying to position a current **deal into it.

Innovation:

Is this something like something else that exists, but slightly different? Or something completely new.

Execution:

How far along is your team with the means they have? Did you barely start – or are you already making billions in revenue?

Credentials

Did the founder start a similar company in a similar space and sold it for billions, did the globally best investor in this field invest in it; maybe even join as co-founder? Or is it a group of people with some but unrelated credentials in their background?

Rule of thumb #1: The more you lack on one axis the more you need to compensate in the others.

- If you have little innovation to the market leaders you need to have strong execution and/or credentials.

- If you have little execution you need to bring strong innovation and/or credentials.

Rule of thumb #2: To close an investment round you should be strong on two axis or very strong on one

- No-name teams should bring a new approach to a problem and have first solid first steps that proof their skill and market interest. (the more of the latter the better)

- People with pre-existing credibility (eg exit from previous company) might be able to fundraise on their strong credibility alone.

Quick notes when thinking in this model:

Execution centric fundraises are the hardest

If you struggle to explain how you are innovative and you lack strong credentials (founders or investors on your captable) – you are left to raise on pure execution.

A common feedback by investors is: “Come back with 2-3 more months of traction”

Translated this just means, that they don’t see (or trust) your innovation & credentials, and hence ask you to prove yourself via execution markers.

If you can convince the market and make a lot of money, they have either misjudged your innovation (and customers have seen it correctly) or you are just really good in execution – in either cases it’s worth a second look for investment.

Translated it means “It's a no, but if you are absurdly successful over the next weeks please call us again.”

Framework #2: Core-bets vs side-bets

Every VC investment is a series of bets that the investors make.

It helps to think of your own company the same way

What are make or break bets for this startup?

What needs to be true for you company to succeed?

Typical bets

- Is the innovation the team focuses on actually working as they believe?

- Is their niche going to be big enough in future?

- Will XYZ really work?

- Will ABC be cheap enough on scale?

- Is XYZ the right distribution channel for this?

- Is the trend of ABC going to continue?

- Is this the right team composition?

- Can they achieve needed regulation/partnerships/compliance/etc with this approach?

- Can they win the race against time with competitor-A/market-trend-B/technology-commoditization-C

If there wouldn't be any risky bets, risk capital investors wouldn't be needed.

Bets that are make or break to a business are core-bets Bets that enhance the business, or are just less risky in general, are side-bets

If VCs write large rounds they need to “subscribe” to multiple of those side-bets and usually all of the core-bets.

Smaller investors, like me, can subscribe to just some of those bets and rely on the expert opinion of others in the round for the rest.

This is where you can act strategically about your round.

If you struggle getting your first checks consider approaching experts for the core-bets of your business first.

"A new rocketship engine and Elon Musk invested?!"

This allows investors who lack the rocketship engine experience to trust the experts who already invested before them.

The other advantage of this approach is that it allows you to approach experts who

- a) get less flooded by startup investment requests and

- b) even if they don’t invest can give you very valuable advice.

Summary

- Two mental models

- Innovation, Execution, Credentials

- You should be strong on two or very strong on one to efficiently raise a round

- Bets

- Structure your company as series of bets (market, tech, or otherwise) and have experts for these bets subscribe first

- Innovation, Execution, Credentials

About my investment bias

First check vs co-investing

With my fund i am happy to invest as the first check in IF global work or engineering is the core-bet in the product. In those kind of products/startups i can also bring the needed credibility to drag along other investors.

If global work or engineering is an (important) side-bet i tend to transparently prefer to wait for an investor who has credentials in the core-bet's topic to invest first. Especially if i do not fully understand the science or market behind the innovation.

Once this investor is in i am game to subscribe to the global work or engineering-related side-bet and invest.

My Bias in this 3d space

Transparently: Given that I invest VC capital and that I invest very early stage I tend to prefer teams with strong innovation. Execution is important but things can always accelerate very quickly. I usually care less about credentials as I invest globally where credentials break down quickly compared to SV-centric investing.

Giving Feedback:

Most teams are somewhere in the middle of the 3d space and have a mix of bets. I tell them where I position them and write down that feedback for myself to hold myself accountable in future or when we talk again a few weeks/months later.

Hope this helps

Please send me any feedback or questions you have. Also feel free to send PRs to improve this post.